36+ mortgage debt to income ratio limit

According to the 2836 rule. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Retirement And Consumption In A Life Cycle Model Journal Of Labor Economics Vol 26 No 1

Web You have an opportunity to improve your DTI ratio.

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

. Apply Get Pre-Qualified in 3 Minutes. Web FHA loan income requirements in 2023. Banks and lenders have different acceptance.

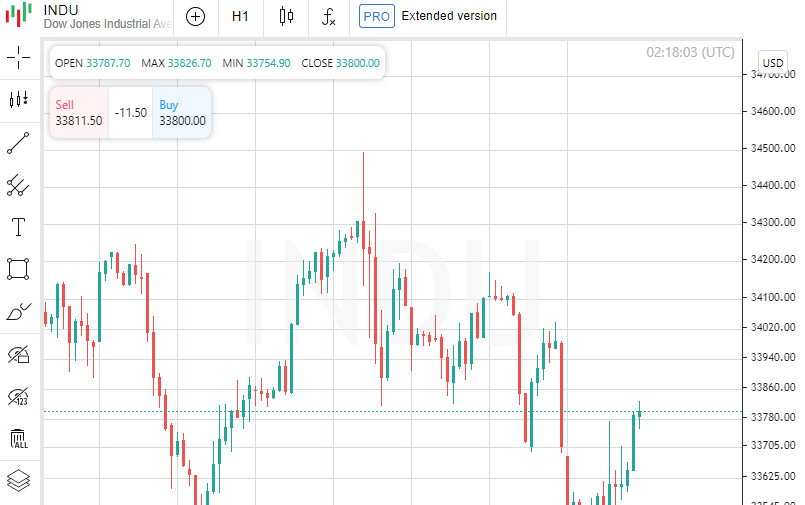

Youd then multiply that by 100 to get your final debt-to-income ratio of 30. Web Calculating your debt-to-income ratio DTI measures your debts as a percentage of your income. What sources of income qualify for an FHA loan.

Web Generally for mortgages lenders will look for borrowers to have a DTI ratio of 43 or less and a DTI thats lower than 36 may be ideal. Ad Compare Mortgage Options Calculate Payments. Get Your VA Jumbo Loan.

Web To find your DTI youd divide 1500 by 5000 to get 03. Your debt-to-income ratio DTI is your total liabilities and debts divided by your gross yearly income. That means 30 of.

Are there income limits for an FHA mortgage. VA Expertise Personal Service. Contact a Loan Specialist.

Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. Ideally lenders prefer a debt-to-income ratio lower. Remember the DTI ratio calculated here reflects your situation before any new.

No more than 28 of your income The front-end ratio is how much of your income is taken up by your housing expenses. A lower DTI ratio shows. Compare Mortgage Options Get Quotes.

If partner A earns 125000 annually and partner B earns 75000 annually the total yearly income. Comparisons Trusted by 55000000. Some lenders may accept a debt-to-income ratio of.

Get Started Now With Quicken Loans. Ad Highest Satisfaction for Mortgage Origination. Web The total debt level is 650000 50000 5000 705000.

Youll usually need a back-end DTI ratio of 43 or less. Web Front-end ratio. If your home is highly energy-efficient.

Web Key Takeaways. FHA loan minimum credit score. Web Here are debt-to-income requirements by loan type.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Apply Now With Quicken Loans. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Monthly debt obligations divided by. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the. Web How to calculate your debt-to-income ratio.

The rule says that no more than 28 of your gross monthly income. In the United States lenders use DTI to qualify home-buyers. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses.

Best Mortgage Lenders in California. Web Most traditional lenders require a maximum household expense-to-income ratio of 28 and a maximum total debt to income ratio of 36 for loan approval. In reality however depending on your.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. Web S the quality maximum limitation into straight back-avoid proportion try 36 on the antique mortgage financing What exactly is a personal debt-to-Income Ratio. 45000 36 16200 allowed for housing expense plus recurring debt.

Web Your maximum for all debt payments at 36 percent should come to no more than 2160 per month 6000 x 036 2160. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Apply Online To Enjoy A Service.

Ad 5 Best House Loan Lenders Compared Reviewed. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. Web Gross Income of 45000 45000 28 12600 allowed for housing expense.

Save Real Money Today. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

![]()

Non Qm Non Agency Jumbo Residential Loans Stronghill

How Much House Can You Afford The 28 36 Rule Will Help You Decide

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Mortgage Calculating Debt To Income Ratio Using Property Income Debt

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

Learning About Debt To Income Ratio

What Is The Max Debt To Income Ratio For A Mortgage Quora

N1aytx Rjow Om

Debt To Income Ratio

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Ratio And Why Does It Matter Loantube

How To Calculate Your Debt To Income Ratio Step By Step Mymove

What Is The Debt To Income Ratio For A Mortgage Freeandclear

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

Debt To Income Ratio Limit To Qualify For Mortgage Loan